Hello everyone! In 2016 I did seven trades that I listed below, so you can see the results.

I am listing these companies according to the opening date.

Cummins Inc. (CMI: NYSE) 2016.01.13 – 02.10.

Opening price: 86,93 USD

Opening date: 2016.01.13.

Cost of transaction: 0,6%

Closing price: 96,2 USD

Closing date: 2016.02.10.

Result of the trade: +10%

Cummins reached the bottom of a big trend, giving me great opportunity to open the position. I was satisfied with the quick result, in spite of the fact that I should have holded this trade.

Infosys Limited (INFY: NYSE) 2016.01.13 – 03.28.

Opening price: 16,88 USD

Opening date: 2016.01.13.

Cost of transaction: 0,6%

Closing price: 18,79 USD

Closing date: 2016.03.28.

Result of the trade: +10,7%

Infosys is a very progressive company and volatile paper. Considering its nature I closed it at market price as soon as it reached the top. Considering the duration of the trade the result was average.

Danaher Corporation (DHR: NYSE) 2016.02.25 – 04.01.

Opening price: 87,12 USD

Opening date: 2016.02.25.

Cost of transaction: 0,6%

Closing price: 94,02 USD

Closing date: 2016.04.01.

Result of the trade: +7,3%

After that double bottom the chance was smoothly to open a position. I closed this at market.

Cerner Corporation (CERN: NASDAQ) 2016.03.29 – 04.22.

Opening price: 52,4 USD

Opening date: 2016.03.29.

Cost of transaction: 0,6%

Closing price: 58 USD

Closing date: 2016.04.22.

Result of the trade: +10%

With CERN I did a bit risky opening but it was remunerative. Less in a month I did make 10%. Superb.

Fossil Group, Inc. (FOSL: NASDAQ) 2016.04.15 – 11.30.

Opening price: 41,28 USD

Opening date: 2016.04.15.

Cost of transaction: 0,6%

Closing price: 33 USD

Closing date: 2016.11.30.

Result of the trade: -20,6%

FOSL was my biggest mistake and my biggest salvage at the same time. In April had been a large decline in the price, so it showed as a great opportunity to open a position at that low price. But during holding the position the company’s performance was getting worse and worse. And this sudden decline reflected very seriously in the price. I had to be very patiant not to close the position in the big downward trend. In the end I managed to close the position to lose as little as possible.

This trade was a great example that anything can happen at stock market and you have to be very prudent and well-informed to minimmize your loss and have to be enough risk taker not to miss great oppurtunities.

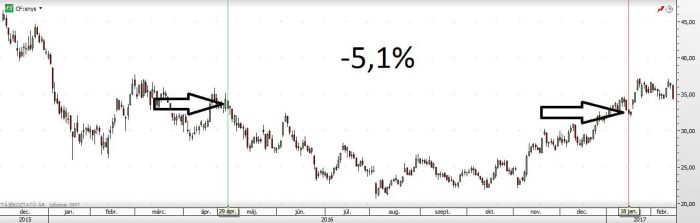

CF Industries Holdings, Inc. (CF: NYSE) 2016.04.29 – 2017.01.18.

Opening price: 33,56 USD

Opening date: 2016.04.29.

Cost of transaction: 0,6%

Closing price: 32,04 USD

Closing date: 2017.01.18.

Result of the trade: -5,1%

The opened position of CF was a similar to FOSL in that time. I managed to minimize the loss and close it at market price.

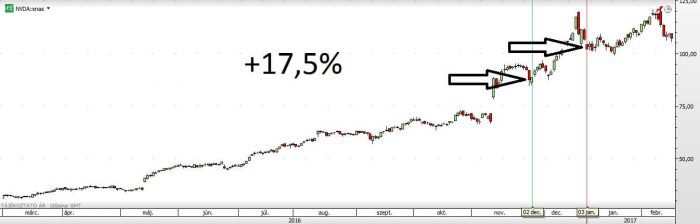

NVIDIA Corporation (NVDA: NASDAQ) 2016.12.02 – 2017.01.03.

Opening price: 86,33 USD

Opening date: 2016.12.02.

Cost of transaction: 0,6%

Closing price: 102 USD

Closing date: 2017.01.03.

Result of the trade: +17,5%

Many times taking risk could be rewarding. Because NVDA was not among the best performing companies in that time. Thanks to a cryptovaluta frenzy Nvidia was getting better and better in performance. The gap formation was a great but risky sign to open this position and the bearish engulfing formation was a sign to close it. It was nice.

Recent Comments