Hi everybody!

I wish you a happy new year full of success and health!

Let’s start the new year and take a look at the 2021 yields of SpEFEKTETO.

I have some Deja Vu feelings about in relation to last year’s appraiser, as I’m not completely satisfied right now, both swings “A” and “B” underperform (so far), but like last year, at the moment my swing positions are still active. I HAD WRITTEN THIS LAST YEAR: I didn’t shut them down, it’s a market-dictated situation that has brought us a little calmer swinging (if there’s such a word). The key word is patience! THE SAME THOUGHT IS CORRECT EVEN NOW. On the other hand, the Complex Portfolio “C” performed outstandingly, better than in 2020, even though it was also successful!

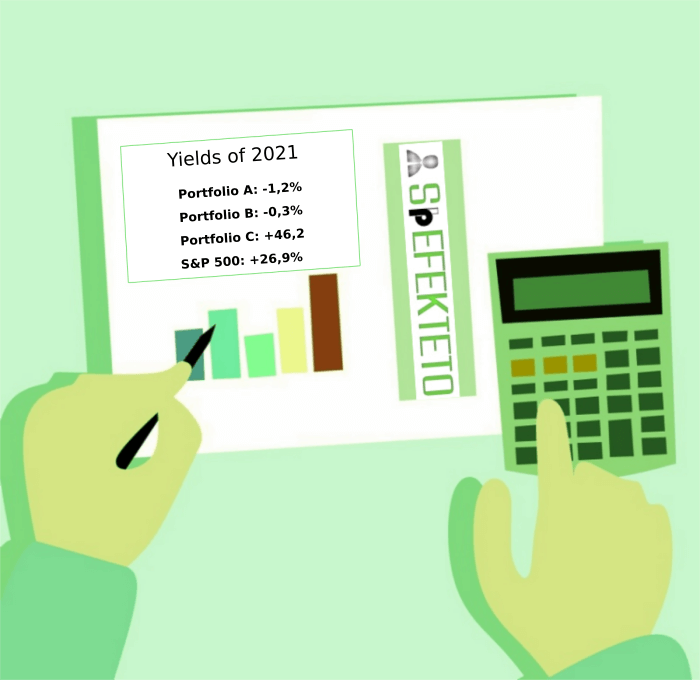

Here are the performance of the three available portfolio packages in 2021! Remember, portfolios “A” and “B” are part of portfolio “C” and not separate portfolios.

Portfolio A: -1.2%

I opened this swing position at a good price in November 2020, although there were a few days when it could have been closed with a significant profit, but there were / are more and there was no significantly better alternative, so I will definitely hold the position. For new investors, this swing currently gives them a better buying opportunity (at a great price now) than it has given me!

Portfolio B: -0.3%

There are two swings here, one in the “A” portfolio, and another swing with the “B” portfolio. For this second swing, I can say the same as I said for the first swing in last year’s portfolio “A” then. I wrote this last year: “We currently have an open position at a very good price, pushed further down by a strong negative sentiment, giving new investors even better boarding opportunities, don’t delay!” I WOULD LIKE TO ADD THAT THIS PAPER IS CURRENTLY EXCELLENTLY PRICED.

Portfolio Complex C: + 46.2%

And that’s very okay, EVEN BETTER THAN 2020! This return was able to come out with Long trade papers making a 63.99% return in 2021!

By comparison, the yield performance of the 500 largest companies in America (S&P 500) was + 26.9%. This is 10.6 percentage points better than in 2020!

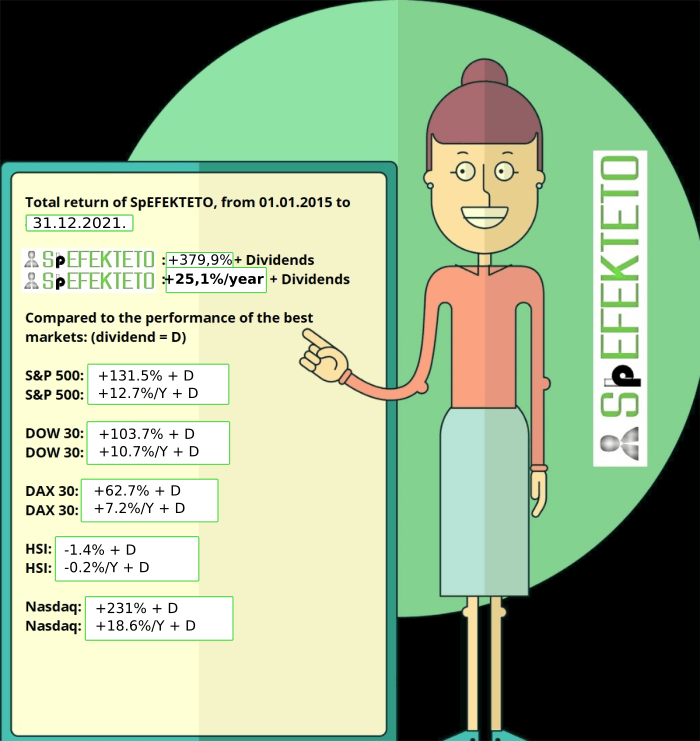

Let’s also look at the overall picture, the returns of the last 7 years from inception.

“This is a figure that really fills me with satisfaction, I won’t be conceited. I will continue to strive for improvement and to make the most of the opportunities offered by the market, with the lowest possible risk.” I wrote this last year at this time, which is valid again this year! Interestingly, the sector index Nasdaq was able to improve its performance by only 0.3% (to 18.3-18.6%), while the S&P 500 was able to improve by 2.2% (10.5-12.7%). This is mainly due to the correction / resting of technology papers in 2021 that were extremely overheated in 2020. The Nasdaq achieved a return of 21.4% in 2021, making 2021 one of the few cases where it fell short of the S&P 500 (2021: 26.9%).

Have a nice day and a happy new year!

Recent Comments