Hi everyone!

First of all, I wish you a very happy new year!

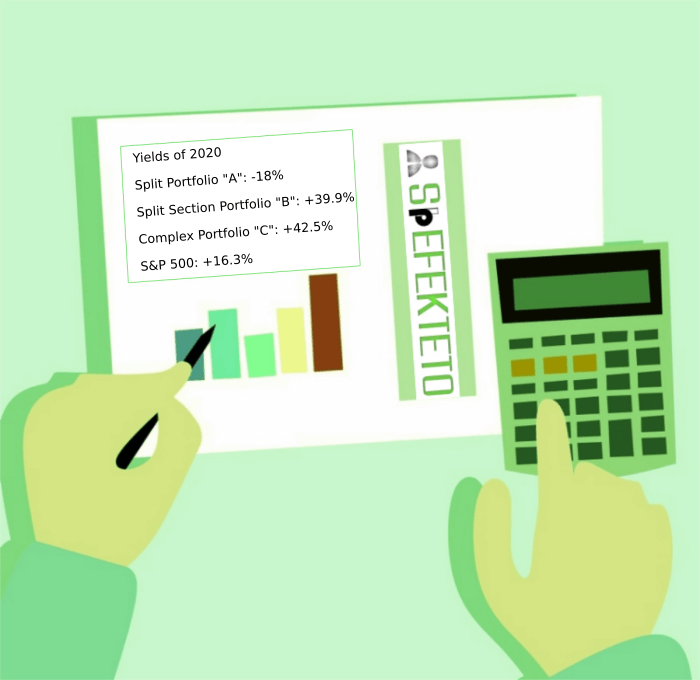

As promised, I calculated SpEFEKTETO’s 2020 returns.

I’m not entirely happy because portfolio “A” underperformed (so far), but I can say that my swing position is still active. I didn’t shut them down, it’s a market-dictated situation that has brought us a little calmer swinging (if there’s such a word). The key word is patience! On the other hand, Complex Portfolio “C” performed excellently and Split Section Portfolio “B” also exceeded my expectations!

Here are the performances of the three available portfolio packages! Remember, portfolios “A” and “B” are part of portfolio “C” and not separate portfolios.

Portfolio A: -18%

We currently have an open position at a very good price, pushed further down by a strong negative sentiment, giving new investors even better boarding opportunities, don’t delay!

Portfolio B: + 39.9%

That’s just fine.

Portfolio Complex C: + 42.5%

And that’s very good!

In comparison, the yield performance of the 500 largest companies in America (S&P 500) was + 16.3%. I would add this is not a bad performance either.

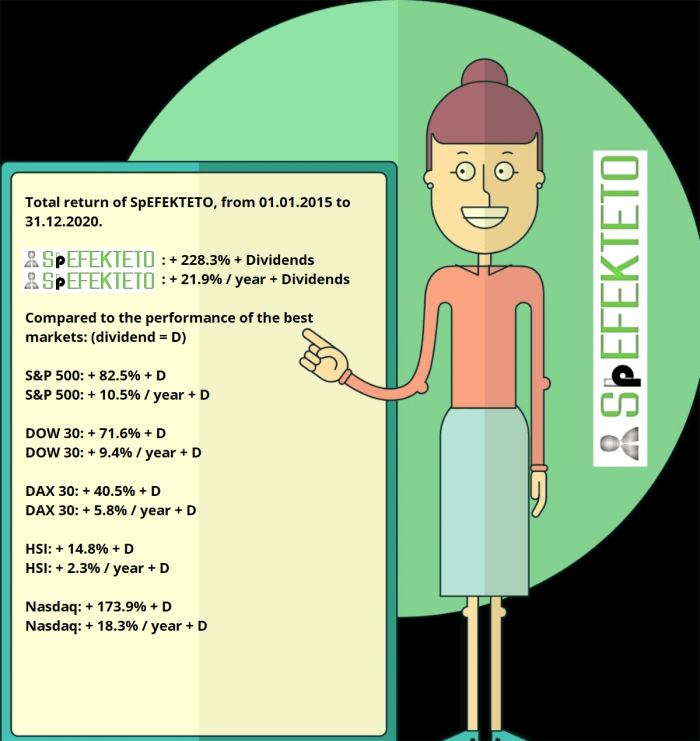

Let’s also look at the overall picture, the yields of the last 6 years, since inception.

This is a figure that really fills me with satisfaction, I won’t be conceited. I will continue to strive for improvement and to make the most of the opportunities offered by the market, with the lowest possible risk.You can see even the sector index nasdaq was managed to outperform with its crazy-priced stocks / risk, yes e.g. I am thinking of Tesla and his associates.

Have a nice day!

Recent Comments