Hi everybody!

I wish you a happy new year full of success and health!

Let’s get started and take a look at SpEFEKTETO’s 2022 numbers.

“I HAD WRITTEN THIS LAST YEAR: I didn’t shut them down, it’s a market-dictated situation that has brought us a little calmer swinging (if there’s such a word). The key word is patience! THE SAME THOUGHT IS CORRECT EVEN NOW.” I wrote this a year earlier, I quoted it, so they cover the 2020 annual assessment. The year 2022 could be roughly described with this tangled paragraph. Because I don’t completely agree with myself. I’m not saying that I made a big mistake, just a little, but it has a significant negative result right now, at this moment. I opened one swing too early, while the other should have been closed. You’re always smarter in hindsight. The futherbuyings during the year improved the performance somewhat.

Well, so that I don’t just kid myself, 2022 was a strong correction year, which is fine. As for long trades, this also affected the performance of these papers, they were dragged by the negative mood of the market, in most cases unjustifiably. Remember that the return was over 40% in 2020 and 2021! So, if you haven’t joined yet and are reading these lines, now is the time to do so, because there are papers from excellent companies at very good prices. 2023 will be the year of boarding!

In addition to these, there was one more important thing that I cannot leave out, namely the simplification of the service – only the entire complex “C” portfolio is available – and in addition to stock speculation (swing trade), crypto was also included in the portfolio.

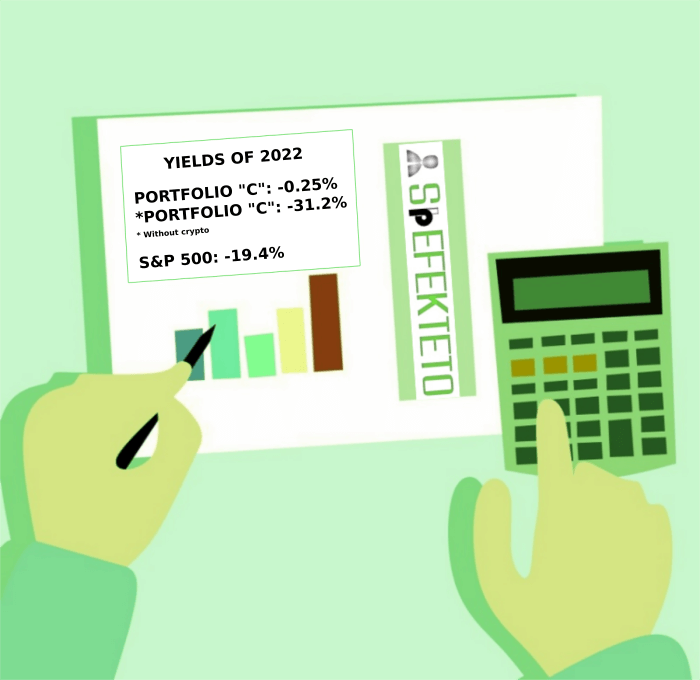

Let’s look at the numbers!

As I predicted, I managed to underperform the market (S&P 500) by 11.8 percentage points. It was the first of its kind since the launch (8 years), which I’m not happy about. -31.2% is not a pretty number, even if the market also made a significant loss with its 19.4%. Small consolation is that the NASDAQ fell 33.1%, beating it by 1.9 percentage points. Within the portfolio, the return on long trade shares was -36.1%.

HOWEVER! By adding crypto assets to the portfolio – most of them already in 2021 – the loss was eliminated. An important detail is that there is a bit of fraud in the calculation, because as far as the crypto yield is concerned, +106.3% (2.063x) is not due to the year 2022, but primarily to 2021. But since 2022 was the first full year (2021 was a truncated year for crypto), therefore, I am referring to 2022.

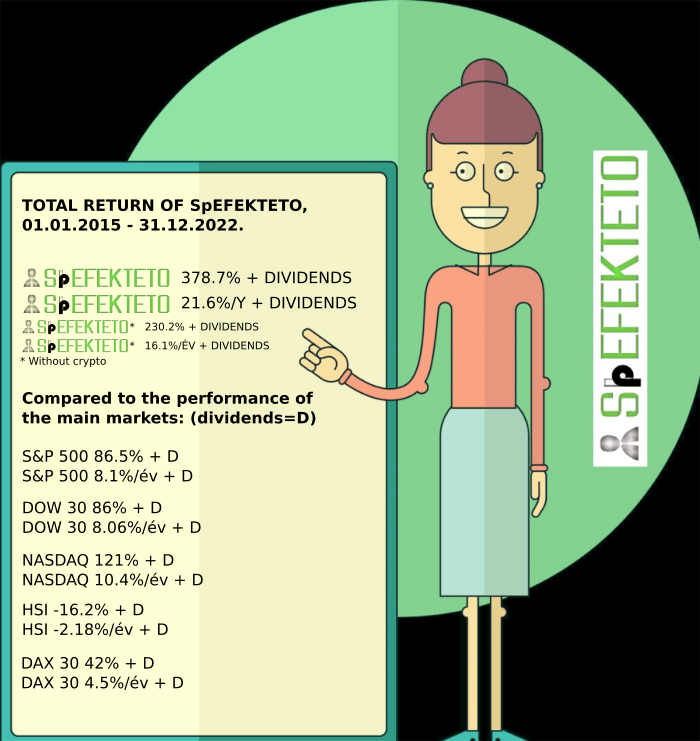

The overall picture, from the start (8-year return)

Based on the 8-year return from the start, we outperform:

S&P 500 by 292.2 percentage points. 143.7*, with 13.5 percentage points per year. 8*

NASDAQ by 257.7 percentage points. 109.2*, with 11.2 percentage points per year. 5.7*

Performance of some funds/indexes and investors that I still follow based on 8 years: (source: google.com)

Vanguard IT fund: 207.5%, 15.1% per year, i.e. outperformed by 171.2 percentage points. 22.7*, with 6.5 percentage points per year. 1*

Warren Buffett Berkshire Hathaway Inc Class B: 108%, 9.6% per year, i.e. outperformed by 270.7 percentage points. 122.2*, with 12 percentage points per year. 6.5*

BUX Index: 155%, 12.3% per year, i.e. outperformed by 223.7 percentage points. 75.2*, with 9.3 percentage points per year. 3.8*

The following are the returns calculated based on the last 10 years: (source: stockcircle.com)

Warren Buffett, Berkshire Hathaway Portfolio: 116.46%, 8.03% per year, i.e. outperformed by 262.24 percentage points. 113.74*, with 13.57 percentage points per year. 8.07*

Jim Simons, Renaissance Technologies Portfolio: 120.97%, 8.25% per year, or outperformed by 257.73 percentage points. 109.23*, with 13.35 percentage points per year. 7.85*

Michael Burry, Scion Asset Management, LLC Portfolio: 328.1%, 15.65% per year, or outperformed by 50.6 percentage points. -97.9*, with 5.95 percentage points per year. 0.45*

Ray Dalio, Bridgewater Associates Portfolio: 21.12%, 1.93% per year, or outperformed by 357.58 percentage points. 209.08*, with 19.67 percentage points per year. 14.17*

As an interesting fact, inflation in Hungary was 4.975% on average in the last 8 years.

Note: I do not count Jim Simons’s Medallion Fund because, on the one hand, I only found continuous data up to 2018, and what I also found was that his return was 48% in 2021 (SpEFEKTETO Portfolio “C” 2021: 46.2%), on the other hand , is a closed fund in which you cannot invest. Regardless, I would like to beat the fund considered to be the best in the world, with a gross return of 66.07% per year between 1998-2018, which is 39.2% per year after deducting performance fees!

(* Performance of SpEFEKTETO without crypto)

Summary: ONWARDS!

Recent Comments