Update 09.05.2022.

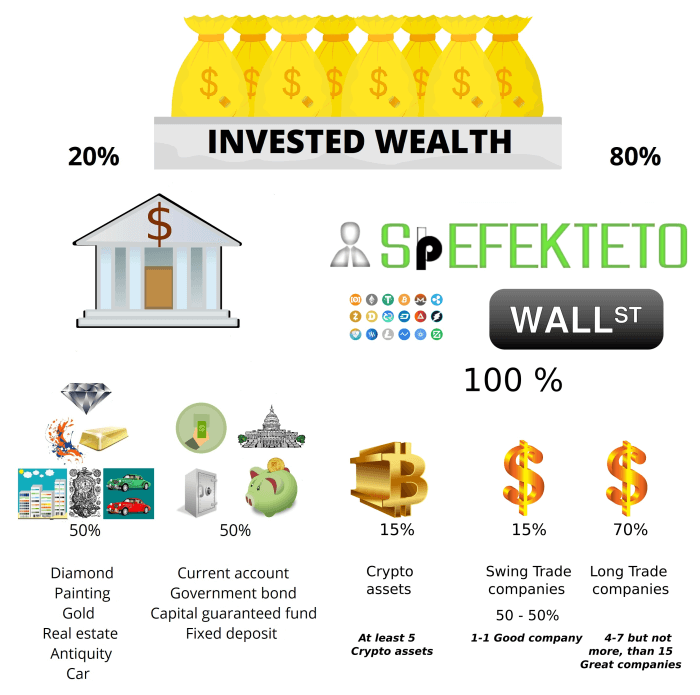

With the inclusion of crypto assets in the portfolio, the optimal proportions of the asset portfolio changed slightly.

Hello everyone!

This is a very important topic in investment world and now I give you some tips how to build a balanced investment portfolio. This is my subjective opinion based on my experiences so far.

STEP ONE

You must separate your investment money from your income for everyday living and current expenditure. Actually this is the money that you have saved during the years. At least I hope so. If you are young you are just starting to save. Anyone who manages to set aside 10-20% on a regular basis in the long run and invest this will have no problem building wealth.

This savings will be the money you have to invest. All of your savings may include your heritage or the amount of selling of your properties etc. It’s called the invested wealth.

Of course you can ask for help of some brokerage companies, investment advisors etc. but if you don’t want to spend a lots of money on those valuable advice then you can build your own portfolio yourself.

And now let’s admit it to ourselves that those “valuable” advice aren’t always as valuable as you thought those were. Many times there are big differences between the price and the value of advice.

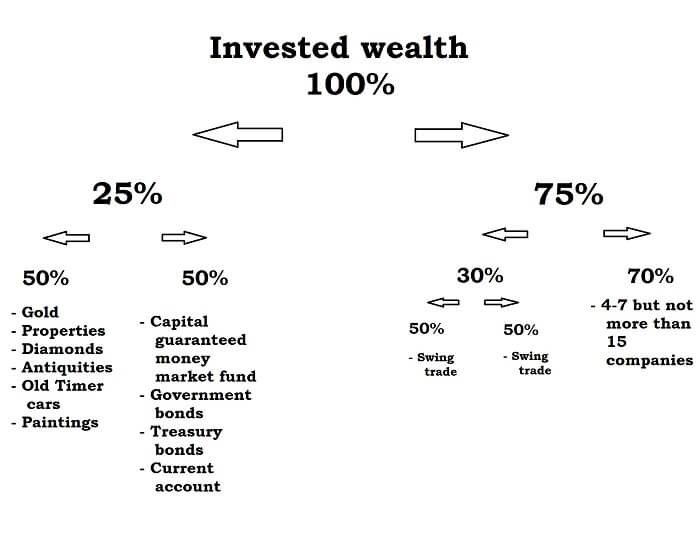

Back to the invested wealth. Here I’ll show you how to divide that wealth.

STEP TWO

The bigger part of the portfolio is the stock market portfolio. This section includes those shares that you can find in SpEFEKTETO’s blog too. This is the 75% of the invested wealth.

This portfolio section includes both the long term (Long Trade) and the short term (Swing Trade) approaches. The main parts of it (70%) are the long term trades in which you can buy and hold those companies that meet the highest expectations.

In the best scenario you can hold these excellent companies even for 10 years or more! And you will receive not just the significant gains in the prices but also the dividends. You will also experience the beneficial effect of the compound interest. Moreover, there is one more important thing, if you own shares in companies in the long run, you can enjoy tax benefits. Recommended reading: Warren Buffet portfolio.

The smaller parts of it (30%) are the short term trades. Here you can buy and hold companies for an average of one to three months.

These companies are also good and need to comply several expectations but here it’s not the point. Swing trade is about timing, beacause when you find a good enough company and catch it at its best period then you can reach extra profit, all with lower risk compared to a traditional swing trading strategy.

In order to handle the risk involved, you have to divide that swing trade into two. At this point, the best risk-return ratio is achievable.

What I would also like to note is that it is worth keeping the Long and Swing portfolio parts in a separate securities account for easier transparency and manageability!

So this is what your stock portfolio looks like.

EQUITY PORTFOLIO WEIGHTING – REBALANCING – DIVIDEND REINVESTING

The weighting of the stock is basically 1: 1, which means that when you start your portfolio, the shares you put in will start with equal weight. In English, the individual shares are divided equally in both the Long trade and Swing trade portfolios.

There can often be a specific case where after joining (because you are joining an already existing portfolio) several of the Long trade companies are trading at a higher market price than the recommendation price range (Safety Margin – Intrinsic Value, you will find this in the guider). By definition, you should not buy these companies at higher prices, your job is to wait for the market price of that company to be at least below intrinsic value. It is best to buy near the safety margin. Safety margin = 30% below the intrinsic value!

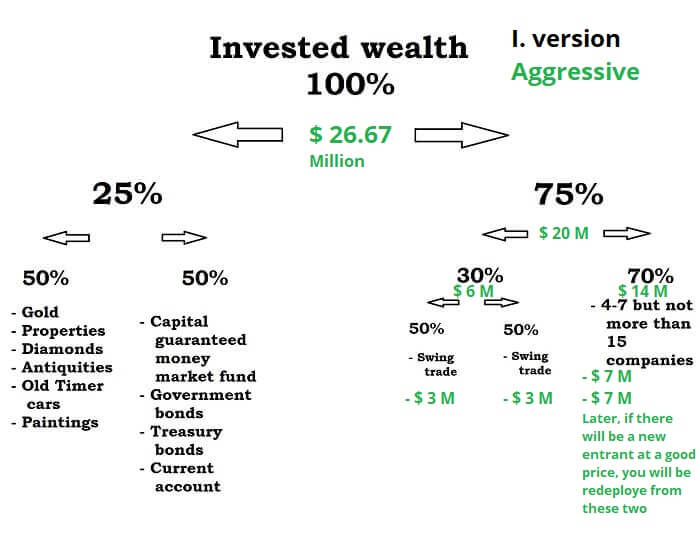

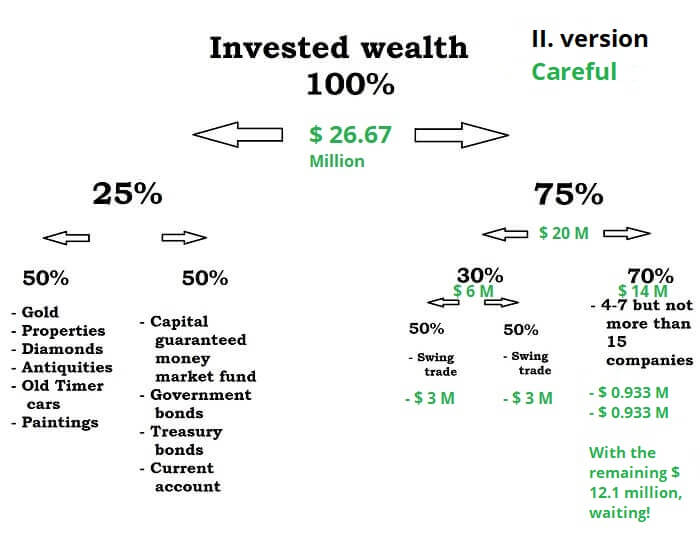

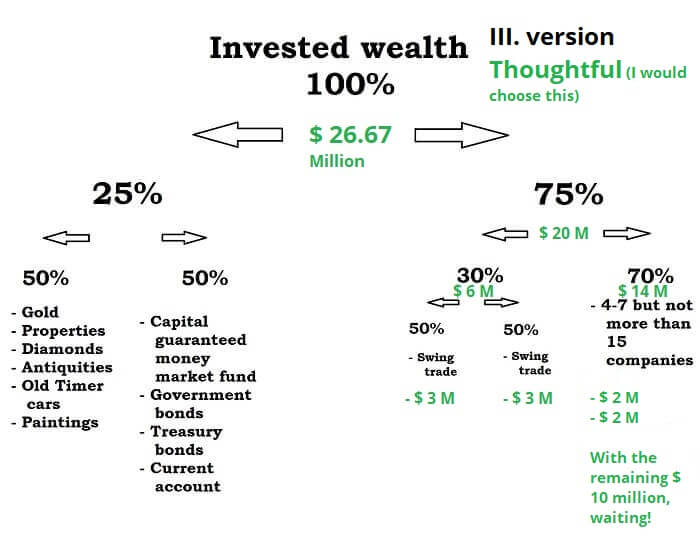

But then how do you distribute and invest the amount in Long trade? There are three versions for this, I. Aggressive, II. Careful, III. Thoughtful.

Consider the specific case with the following characteristics: you intend to invest $ 26.67 million, of which $ 20 million will go to the spefekteto’s equity portfolio, when you join, a maximum of 15 companies will be in the Long trade section and only 2 of these will be available below intrinsic value in the market.

Aggressive

In the aggressive version, you should split the Long trade $ 14 million between the two available companies below intrinsic value in equal proportions. If another company becomes available for purchase below its intrinsic value, you will proportionally transfer into the new company from these existing $ 7-7 million.

In practice, hopefully by then the value of existing companies will be worth more than $ 7-7 million, if, for example, one grows to 7.5 another grows to 7.8 million dollars, your portfolio will be worth a total of 15.3 million dollars. You divide this amount ($ 15.3 million) into three equal ratios in the case of a new entrant , as three companies will be in your portfolio by then. So you invest $ 5.1 million in the newly entered company (15.3 / 3 = 5.1), you have to sell a proportionate number of shares of the existing two companies so that the value of their individual shareholding is $ 5.1 million. (share price x number of pieces = value of the given company’s portfolio; $ 100 x 78,000 pieces = $ 7,800,000) Recalculated from this formula, you get: (the value of the portfolio of the given company – the already proportioned part = the part to be proportioned) For the sake of quicker understanding, I calculate a share price of $ 100.

In this particular case: $ 7,800,000 – $ 5,100,000 = $ 2,700,000, it follows that $ 2,700,000 / $ 100 = 27,000 shares. That is, you have to sell from one of the existing company 27,000 shares , while from the other existing company: $ 7,500,000 – $ 5,100,000 = $ 2,400,000, hence $ 2,400,000 / $ 100 = 24,000 shares, i.e. you have to sell 24,000 shares of this company.

This gives you $ 5.1 million to be redeployed to the new entrant. (27,000 db x $ 100) + (24,000 db x $ 100) = $ 5,100,000

Careful

Based on the same specific case, in the careful version, you divide the $ 14 million for Long trade into 15 equal parts, so you get $ 933 thousand per company. You do not have to reallocate here, as your remaining $ 12.1 million is on the parking lot. You wait and when a new company becomes available below its intrinsic value, you have to invest $ 933 thousand out of $ 12.1 million.

Thoughtful

Based on the same specific case, in the thoughtful version, you divide the $ 14 million for Long trade into 7 equal parts (7 because in the long run this number will be around the number of companies entering Long trade, and this is the most optimal) so you have $ 2 million per company. You don’t have to reallocate here either, as your remaining $ 10 million is in the parking lot. You wait out and when a new company becomes available below its intrinsic value, you have to invest $ 2 million out of $ 10 million. If over time the portfolio has been replenished and you have already invested all of your $ 10 million, but there will be an 8th company that can be purchased below its intrinsic value (assuming you do not invest additional amounts in the portfolio) you will need to rebalance the portfolio!

Note: All three versions also have advantages and disadvantages, but the specific market situation can help you choose. In a mostly overpriced market like today, a thoughtful or careful version may be more rewarding, while in an average market environment (such as 2014-2018), an aggressive version may be more effective. Regardless, each version works well and over time, the initial effects they cause are eliminated.

Rebalancing the portfolio is bringing the value of each company to an equal proportion within our entire portfolio. During the redeployment presented for version I, a kind of rebalancing took place.

A practical example of rebalancing:

Given two assets (eg corporate shares in our portfolio)

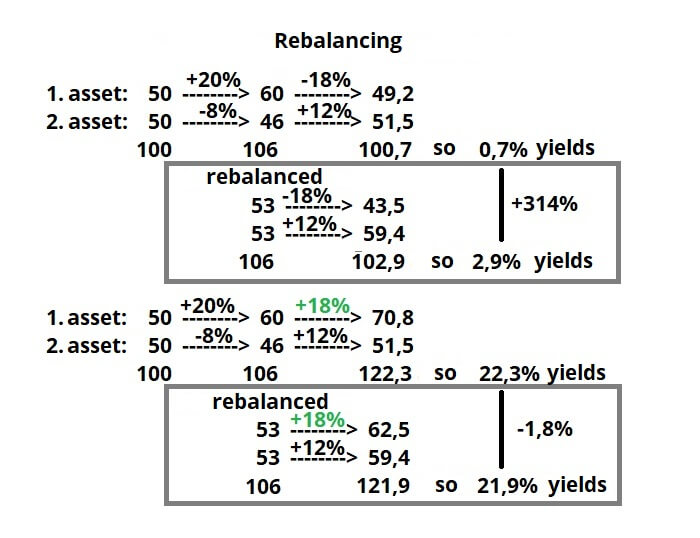

Rebalancing in a practical example

As you can see in the figure above, balancing works like diversification. Portfolio balancing is a risk-sharing for price, just as diversification is a risk-sharing for companies. This results, as in the case of diversification: The more efficient a portfolio selection system, the less effective the application of balancing. This is also true for diversification, as a maximum of 15 shares in a stock portfolio (spefekteto) is not the pinnacle of diversification when there are fund managers where up to more than 100 stocks make up a portfolio! Buffett used to say, if you knew the names of the best companies, why would you include more companies in your portfolio, which would only reduce your return.

This is also true for balancing. Sometimes (every 1-3 years in the case of Swing trade, every 5-10 years in the case of Long trade) it may be necessary to rebalance the portfolio, but it should not be exaggerated either, because we can achieve the opposite effect with it. In the example above, in the upper rectangle, balancing had a significant positive effect on returns, as both assets performed mixed, so by sharing risks (adjusting the value of both assets equally, adjusted to 53-53), a significant, return of 314% more was achieved, than without balancing. In contrast, in the lower rectangle, already this risk sharing ended with a negative result, -1.8%. Why? Because in this case it is the 1st asset of the 2-asset portfolio consistently and significantly performed better than asset 2. This result would deteriorate further by prolonging the period under review (assuming a constant outperformance of asset 1 over asset 2), i.e. the risk-sharing effect of rebalancing would result in a significantly lower return than without rebalancing.

Note: When choosing rebalancing, it is worth considering not only the time elapsed in the portfolio, but also the performance differences of each asset and their reasons. If the (periodic) underperformance of an asset relative to another asset is due solely to market sentiment, it is against rebalancing, while if it is due to a fault in the stock selection system, it is in favor of rebalancing.

Dividend investing is the third topic we need to address. There are two ways ahead of you, reinvesting it or not. It sounds simple, but it does have a significant impact on the value of your portfolio.

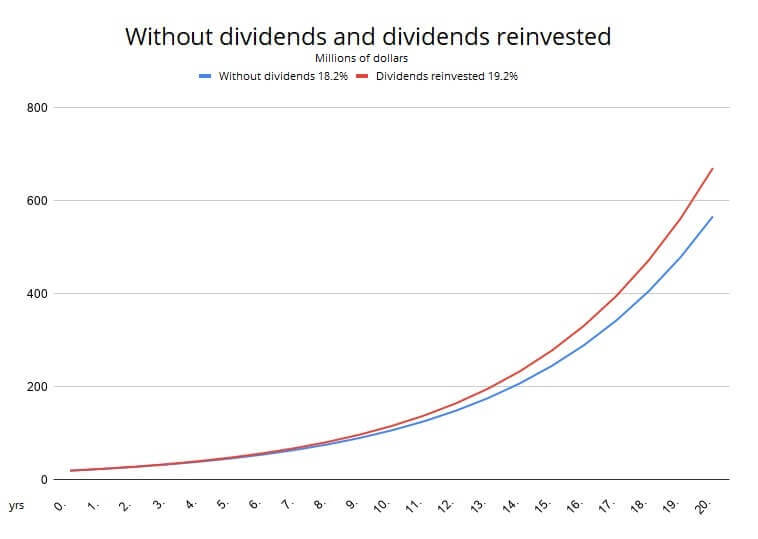

Without dividends and dividends reinvested ($ M) 20 years, $ 20 M

In short and concise, this means that by the end of Year 10, the portfolio is worth by 8.8% more (plus $ 9.4 million, in a start-up $ 20 million portfolio) than without reinvesting dividends. By the end of the 20th year, 18.4% (this is $ 104 million plus for an initial $ 20 million portfolio) is the surplus! The data show the returns of the spefekteto’s Complex Portfolio “C” (18.2%; 19.2%), the starting unit: 20.

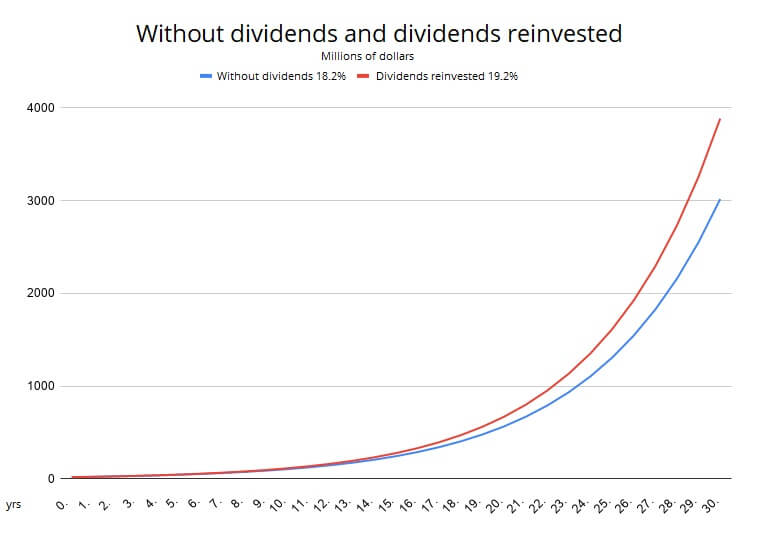

Without dividends and dividends reinvested ($ M) 30 years, $ 20 M

All this, examined over a 30-year period and relying on previous data, means that by the end of the 30th year, our portfolio will be worth 28.8% more! With the $ 20 million start mentioned earlier, that’s $ 867 million plus! That’s what I used to say, time is your friend.

STEP THREE

The smaller part of the portfolio is a group of alternatives. This section includes those elements that you can invest in beyond the stock market. This is the 25% of the invested wealth.

This portfolio section includes both material and immaterial elements in 50-50%.

I review some of these.

Gold: has more liquidity, only physical gold recomended with the proper certificates, problematic storage, buying at in times of economic crisis or at least 30 – 50% downturn, average volatility. Safety (panic) and speculative asset. Annual return: 8.6% over the last 50 years.

Properties: have less liquidity, can not be moved, amortization, balanced volatility, long term, multi-purpose use. Annual return: 5.6% over the past 20 years, EU average 2-3%.

Old timers: have less liquidity, requires high expertise, higher yields than average, problematic storage, high capital requirements in general, but there are exceptions. Annual return: up to annual: 10-15%.

Capital guaranteed money market funds: have great liquidity, banking risk/banking security background at the same time, easily accessible, lower yields than average, low capital requirements. Annual return: 0-3%.

Government bonds: have average liquidity, buying at in times of economic crisis or at least in the pessimistic times when yields are higher than justified, security is higher than average, yields are avarage. At higher returns, the country risk is also significantly higher, with an annual return of 0-15%. US government bond: 1%

Current accounts/ checking accounts: have the highest liquidity, banking risk/banking security background at the same time, easiest accessible, zero or the lowest yields, low capital requirements, requires low expertise. Annual return: 0-1%

I hope that this article was useful to read, and will help you to make the right investment decisions in the future.

Have a nice day!

Recent Comments